As in all other industries, technology is changing up how CPA firms get their work done, and the profession is only the better for embracing it. Technology is offering better, smarter tools to address routine tasks, giving CPA's more control over their corporate books and facilitating better services for their customers. Further, not only are daily functions evolving but so are the ways that CPA firms are billing out their services, to incorporate the cost of the tech and its value into their fees.

How Are Technology Advances Affecting CPAs?

According to industry experts from the CPA Consultants' Alliance, today's technologies are streamlining accounting practices by providing both automation and integration of services with Professional Services Automation (PSA) software. The consequence is a better-informed workforce that works faster and more efficiently to provide clients and customers with optimal service.

1. Centralized databases connect workers to data and clients

Perhaps the most significant change is the opportunity to collect all relevant data into a single database where any authorized person who needs to see it can reach it. By keeping all interested parties related to a single project connected to a single source of information, every individual can use it as needed and the technology informs the group of everyone's activities as the project progresses. As a time saver, the coordinated database can significantly cut down processing time.

2. Improved workflow

Organizing workflows over projects, sectors or processes has always been complicated, especially when participants in those workflows use different applications to achieve their specific purposes. For larger projects, such as tax preparations for larger companies, tracking the workflow from start to finish has always been a challenge because they involve inputs from many different sources.

Technology that coordinates and integrates workflow activities into a single operation will highlight, then reduce errors, while ensuring that everyone working on the project is working with accurate data from their colleagues.

3. Improved mobility

Today's mobile devices connect CPA's not only to their projects and data but also to their clients and customers. The handheld tech facilitates access to data while away from the desk, so on-the-go CPA's can conveniently check invoices, receipts, accounts, and other client-relevant information. Mobile devices also facilitate "face-to-face" meetings that don't require an actual physical presence, so clients can confer with their accountant from wherever they happen to be at the moment.

Clearly, today's CPA-facing software provides supports and tools that will enhance their work and their client's satisfaction.

Technology Also Facilitates Project Accounting for CPAs

Technology's capacity to automate functions offers CPA's an unmatched opportunity to improve their receipts and billables simply by changing the way they manage their processes. "Project-based accounting", a major component of Professional Services Automation, is the practice of accounting for activity details on a project basis, rather than tracking them on a monthly or quarterly basis, which has been the traditional practice for decades. Since many (or most) accounting jobs are projects, project accounting principles lend themselves especially well to this line of work.

Project management skills also enhance the work of the CPA and are highlighted and enhanced through the use of PSA software. A project manager keeps an eye on all the developments within the project, to ensure that each element is properly completed according to contract and expectations. Project managers can develop keen insights into each aspect of the project, as well as its sufficiency as a whole; project accounting practices give them the data they need to gain those perspectives.

Taken together, project accounting and project management each contribute to enhancing the capacity and value of the CPA firm.

Project Management and Accounting Services Benefit the CPA Office

There are several benefits to project accounting and project management when used in the CPA office:

Project accounting captures detail

Capturing billables and expenses

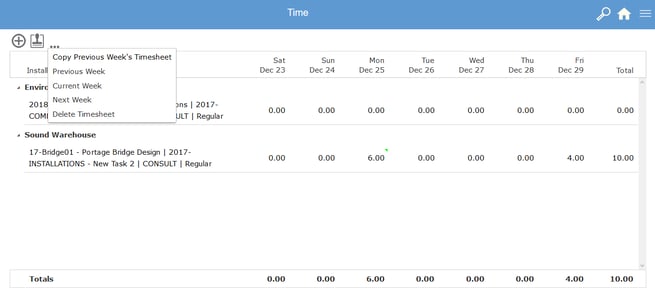

The practice of reporting billable work time on a weekly or monthly (or worse, quarterly) basis can often cause a significant loss if (or when) workers forget to record their efforts on an old-style timesheet. Additionally, when those time entries do finally hit the books, it takes additional effort to attribute them to the appropriate project and client, which is in itself another opportunity for loss if mistakes are made (or worse, the entry fails to make it to the project at all).

With Beyond Software you can capture time & expenses from any web browser or mobile device.

With Beyond Software you can capture time & expenses from any web browser or mobile device.

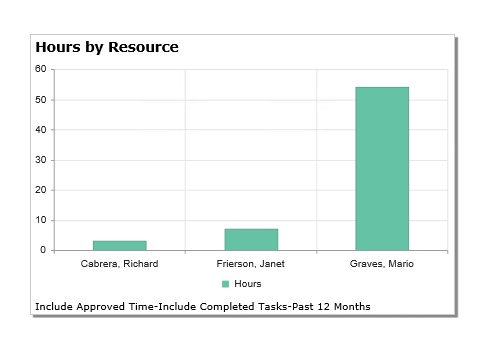

Improved client communications

Tracking the project as a single entity and not just one of many in a list also improves client communications. Today's PSA software lets the CPA track the usage of time and resources, so they can report accurate information about the project to the client at all times.

Additionally, as the project moves forward, the technology allows the CPA to see where time and resources are consumed but not reimbursed, giving them the data they need to support their payment request to the client.

This Beyond Software widget shows how many hours have been booked to projects by individual resource.

This Beyond Software widget shows how many hours have been booked to projects by individual resource.

Enhanced productivity

Project accounting also engages workers better because they assume more responsibility for the project's success. With current data in hand, they can work more efficiently and make better decisions that will impact their future results.

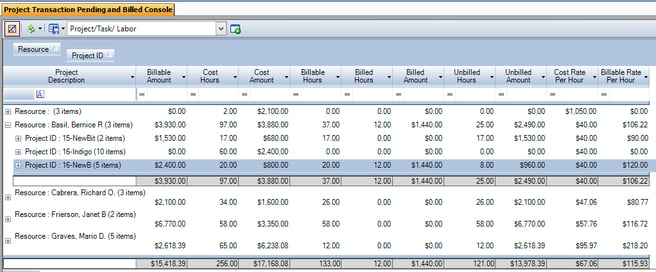

Beyond Software's consoles provide a quick and easy way to leverage your project and financial data.

Beyond Software's consoles provide a quick and easy way to leverage your project and financial data.

Project management offers oversight

From a higher perspective, the project accounting and management method also gives CPA firm leadership deeper insights into how the firm is faring as a whole:

- Individual project data reveals the progress of each project separately while aggregate data reveals the status of the entire portfolio of company labor;

- Data received daily can immediately alert to problems arising anywhere within any project;

- Not least, by shifting a larger burden of daily activities to technology and workers, leadership can focus more on developing client relationships. Leaders can use the insights gleaned from the technology-enhanced accounting processes to provide better advice to their customers and help them to improve their metrics as well.

Technology Facilitates Billing Beyond the Hour

Another benefit gained by adding technology to the CPA practice is the capacity to bill more. Not only does using today's advanced PSA and accounting software in the CPA office reduce errors and improve productivity, but it also offers clients enhanced advisory services and therefore more value. More than one expert now advocates for "value billing" over the billable hour for CPA's. According to Ronald J. Baker, a contributor to CPA Practice Advisor notes that ubiquitous use of the billable hour has been the practice since 1919, despite a plethora of advancements in the meantime that suggested there was a better way to value the work of the accountant.

Today's advanced PSA software in the CPA office reduces errors and improves productivity, while offering clients enhanced services and more value.

Unfortunately, many firms are reluctant to bill more for their value because they are stuck in the "markup of human capital" strategy of billing for accounting services. Instead of placing a value on the full scope of services performed, including digital and analytical services, these firms continue to bill based solely on the work of their human employees and don't embrace the opportunity to bill based on their investments in and usage of the digital tools that enhance their effort.

Consequently, because of the human and digital work done by the CPA firm, the client's outcome improves but the accounting office billables remain stagnant. More firms are becoming aware of this disparity and experts believe that value billing will become the new norm as more firms engage with better technology to improve their accounting business and practices.

Today's technology provides the digital tools needed to capture more accurately all the value of the CPA’s billable hour, while also offering enhanced value that goes beyond just the exercise of the work. Accounting clients benefit from exceptional accounting practices, and when those are tracked on a project basis, the accounting firm also gains extra value from the transaction. CPA firms that invest in PSA technology will not only provide better services for their clients, they’ll be able to bill more for those services, too.

For additional information on Beyond Software please contact:

Nicole Holliday

nholliday@beyondsoftware.com

866-510-7839